Not Found?? Search Here...

Be A Success Trader

To be successful in the trading game, there are some rules you need to follow. By violating the rules, you will definitely on the losing side of the game. Regardless of all the trading books and newsletters that have cropped up, all of the market gurus are sharing and following the same trading rules. You can’t live without them if you want to succeed in your trading.So,please put in mind all these rules,and make it as your routine rules when to start trading. Here are the rules to successful trading, in random order, and they apply in all trading situations:

To be successful in the trading game, there are some rules you need to follow. By violating the rules, you will definitely on the losing side of the game. Regardless of all the trading books and newsletters that have cropped up, all of the market gurus are sharing and following the same trading rules. You can’t live without them if you want to succeed in your trading.So,please put in mind all these rules,and make it as your routine rules when to start trading. Here are the rules to successful trading, in random order, and they apply in all trading situations:

Good luck in your trading...Happy trading! :-)

- Plan Your Trade And Trade Your Plan

- The Trend Is Your Friend

- Focus On Capital Preservation

- Know When To Cut Loss

- Take Profit When The Trade Is Good

- Be Emotionless

- Do Not Trade Based On A Tip From A Friend Or Broker

- When In Doubt, Stay Out

- Do Not Overtraded

9:58 PM | Labels: forex, forex tips, forex trading, learn forex, successful trader | 0 Comments

Risk only small percentage of total account

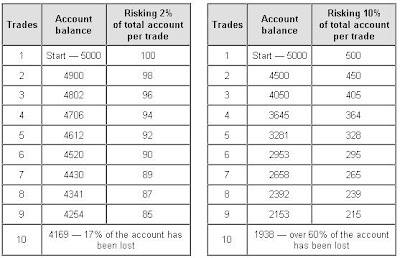

When playing a forex,a money management is very important.Money management is a way traders control their money flow: in or out of pockets... Yes, it's simply the knowledge and skills on managing a personal Forex account.There are several rules of good money management,one of that is by putting a small risk percentage of your total account.

Why is it so important?

The main idea of the whole trading process is to survive!

Survival first, and only then making money on top.

One should clearly understand, that Big traders first of all are skillful survivors. In addition, they usually have deep pockets,which means that under unfavorable conditions they are financially able to sustain big losses and continue trading.For the ordinary traders, the majority of us, the skills of surviving become a vital "must know" platform to keep trading accounts alive and, of course, to make good stable profits.

Let's take a look at the example that shows a difference between risking a small percentage of capital and risking a bigger one.In the worst case scenario of ten losing trades in a row the balance of trader's account will suffer this much. Below are the table of your money management as your guide.

source:freeforextips

11:11 PM | Labels: forex, forex money management, forex tips, fundamental analysis, learn forex, money management | 0 Comments

Another tips for beginners...

Not trading or standing aside is a position.

Not trading or standing aside is a position.

When in doubt , stay out. If you are not clear or cannot predict correctly where the market will move,don't trade. Saving present capital is and absolutely better choice than risking and losing money.

Learn to use protective stops. Respect them and don't move.

Hoping that market will turn in your direction is a very delusive hope. By moving a stop loss further a trader increases his chances to end up with much bigger loss.

"Keep it simple, stupid" — applies to indicators, signals and trading strategies.

If you get too much information,it will create a controversial picture of where to trade and when not to. To avoid lots of confusion create a simple but working method of trading forex.

Think about risk/reward before entering each trade.

How much money can you lose in this trade? How much can you gain? Now, make a decision if the trade is worth entering.

Never add positions to a losing trade. Do add positions when the trade has proven to be profitable.

Don't allow a couple of losing trades in a row become a snowball of losing trades. When it is obviously not a good day, turn the monitor off.Trying to get revenge can often make things worse.

Let your profits run.

Let your position be open for as long as the market wishes to reward you. Of course, for this traders need a good exit strategy, otherwise they risk to give all profits back.

Cut your losses short.

It's better to finish unprofitable trade quickly than wait for the situation to get worse. Don't put a stop loss too far, it's your money you risk.

Trade currency pairs in respect to their active market hours.

Learn about overlapping market hours: when two markets are open and highest volume of trades is conducted. For example, Australian and Japanese trading sessions are overlapped from 8pm to 1 am EST. At that time trader can successfully trade AUD/JPY currency pair.

That's all..and good luck!!

2:40 AM | Labels: forex, forex tips, learn forex | 0 Comments

How does margin trading in the forex market work?

When an traders uses a margin account in trading a forex,they actually borrowing to increase the possible return on investment. Usually, many traders will use margin accounts when they want to invest in equities by using the leverage of borrowed money to control a larger position than the amount they'd otherwise by able to control with their own invested capital.

When an traders uses a margin account in trading a forex,they actually borrowing to increase the possible return on investment. Usually, many traders will use margin accounts when they want to invest in equities by using the leverage of borrowed money to control a larger position than the amount they'd otherwise by able to control with their own invested capital.

Traders interested in trading in the forex markets must first sign up with either a regular broker . Once an investor finds a proper broker, a margin account must be set up. A forex margin account is very similar to an equities margin account, the investor is taking a short-term loan from the broker. The loan is equal to the amount of leverage the investor is taking on.

Before the traders start to trade, they must pay a sum of deposit into their margin account. The amount that needs to be deposited depends on the margin percentage that is agreed between the traders and the broker upon registration or opening the account. For accounts that will be trading in 100,000 currency units or more, the margin percentage is usually either 1% or 2%. So, for an traders who wants to trade $100,000, a 1% margin would mean that $1,000 needs to be deposited into the account. The remaining 99% is provided by the broker. No interest is paid directly on this borrowed amount.However,if the traders does not close their position on the following day or before the delivery date, it will have to be rolled over.Forex brokey may charge the interest depending on the investor's position (long or short) and the short-term interest rates of the underlying currencies.

In a margin account, the broker uses the $1,000 as security. If the trader's position get worse and they losses approach $1,000, the broker may initiate a margin call. When this occurs, the broker will usually instruct the traders to either deposit more money into the account or to close out the position to limit the risk to both parties.

4:23 AM | Labels: forex, forex margin, learn forex, margin trading | 0 Comments

Use Stop Loss Effectively

In Forex trading,stop loss is not a great tool or technique for many traders as it requires taking necessary losses, calculate risks and foresee price turns. However, such money management tool in hands of a knowledgeable trader becomes rather a powerful trading weapon than a tool of disappointment and painful losses. There are several method we can apply stop-loss when start trading

In Forex trading,stop loss is not a great tool or technique for many traders as it requires taking necessary losses, calculate risks and foresee price turns. However, such money management tool in hands of a knowledgeable trader becomes rather a powerful trading weapon than a tool of disappointment and painful losses. There are several method we can apply stop-loss when start trading

Simple equity Stop

According to this rule, a trader would place an order and based on a lot size would calculate amount of pips required to reach the limit of 2-3% of the total account balance (and a stop loss will be placed at that point).

Chart based Stop

There are many approaches to placing protective stops using a chart based stops: stops based on swings high / low, stops using trend lines, fibonacci related stops and so on.

Margin Stop

first, the trader should divide his account into several equal pieces to ensure that the whole capital will not be blown off in one shot.Supposing that a trader plans to spend 15 000 USD, it is suggested that the account opened with a broker "weights" between 1000 to 2000 USD.

6:18 AM | Labels: forex, learn forex, stop loss | 0 Comments

Currency Correlation

In forex trading,some of the currencies tend to move in the same direction,and some of them may move in opposite direction. This is a powerful knowledge for those who trade more than one currency pair. It helps to hedge, diversify or double profitable positions.

In forex trading,some of the currencies tend to move in the same direction,and some of them may move in opposite direction. This is a powerful knowledge for those who trade more than one currency pair. It helps to hedge, diversify or double profitable positions.

Statistically measured by performance, currency pairs are given so called "correlation coefficients" from +1 to -1.

Correlation +1 means two currency pairs will move in the same direction 100% of the time. Meanwhile a correlation of -1 means they will move in the opposite direction 100% of the time.A correlation of zero means no relation between currency pairs exists.

Examples of same direction moving currency pairs are:

EUR/USD and GBP/USD

EUR/USD and NZD/USD

USD/CHF and USD/JPY

AUD/USD and GBP/USD

AUD/USD and EUR/USD

Inversely moving pairs are:

EUR/USD and USD/CHF

GBP/USD and USD/JPY

GBP/USD and USD/CHF

AUD/USD and USD/CAD

AUD/USD and USD/JPY

For what this information?

- A very simple use is avoiding trades that cancel each other. For instance, knowing that EUR/USD and USD/CHF move inversely near-perfectly, there would be no point to go short on both positions as they eventually cancel each other (loss + profit).

- When confident, a trader may double position size by placing same orders on parallel (moving in the same direction) currency pairs.

- Another option would be to diversify risks in trade. For instance, AUD/USD and EUR/USD pairs have the correlation coefficient of about +0.70 which means that pairs are moving mostly in the same direction but not as perfect

6:06 AM | Labels: correlation, currency, forex | 0 Comments

More and more tips just for you...

Here are some of forex tips that i gather from various books and site :

Trading strategies that work well in an up-market may not work in a down-market.

systems that work well in a good trending market may not be applicable at all to a ranging market. The solution is either to have a system for each type of the market or make sure that one solid system will work well under all market conditions

Do not try to pick price tops and bottoms.

Searching for bargains is a good thing when you go shopping, but will put you in troubles if applied to Forex trading. Simply spot the trend and join it like other traders who are serious about trading do.

Always remind yourself that the first and the last market bars/ticks are the most expensive.

Delay entering the market on the first ticks and be out of the market early. On the open, never trade in the direction of a gap.

Never worry about missing out on a trading opportunity.

You are never going to run out of trades, so be firm and stick to your rules.

By using knowledge about currency correlation in Forex traders can easily avoid opening positions that cancel each other

Find out which currency pairs move simultaneously and which — in opposite direction.

Have your stop loss order in place

Put one on a decent distance, for example 100+ pips. Also do not use too tight stop orders as they will most likely be hit more often then you need to.

Spend less time trading Forex but make it quality time.

Trade only when you can be 100% focused

it is wrong to trade with the money that you cannot allow to lose.

Do not trade if you cannot afford to lose your money. Moreover, do not trade if you must make X amount of money per month to pay your bills in order to avoid financial trouble

6:04 AM | Labels: correlation, currency, forex, market trend, pips, price, spend, stop loss, tips, traders | 0 Comments

Forex tips..apply it before you start to trade!

Here are some more tips for the beginner...Please put in your mind before you start!

1. Spontaneous actions in Forex trading — are a part of pure gambling.

Any attempt to trade without analysis and studying the market is equal to a game or gambling.Do not try to trade without any analysis.

Tip 2. Never invest money into a real Forex account until you practice on a Forex Demo account!

You should first try using demo account,before try to trade into real one!!When you're feel comfortable,you can change to the real account.

Tip 3. Go with the trend!

Trend is your friend. Trade with the trend to maximize your chances to succeed. Trading against the trend won't "kill" a trader

Tip 4. Always take a look at the time frame bigger than the one you've chosen to trade in.

It gives the bigger picture of market price movements and so helps to clearly define the trend.

Tip 5. Never risk more than 2-3% of the total trading account.

One important difference between a successful and an unsuccessful trader is that the first is able to survive under unfavorable conditions on the market.

Tip 6. Put emotions down. Trade calm.

This is the most important thing.Don't be greedy by adding lots of positions when winning and if you loose,don't try to revenge after losing the trade.

Tip 7. Choose the time frame that is right for you.

Choosing wise means that you are comfortable and have time enough to analyze the market, place and close orders.

Hopefully some of these tips can help you..

6:40 PM | Labels: forex, investor, tips, trade | 0 Comments

How currency exchange market works

Forex market exists where one currency is traded for another currency. Foreign Exchange Market or formally known as FOREX, is generally works as an international currency exchange market. Investors and speculators now allowed to trade any currencies from all around the world thru the Forex market.

Forex market exists where one currency is traded for another currency. Foreign Exchange Market or formally known as FOREX, is generally works as an international currency exchange market. Investors and speculators now allowed to trade any currencies from all around the world thru the Forex market.

Forex is a very unique type of trading where traders are buying and selling 'money' in the same time. All the trading in forex market are done in pairs, such as Euro/JPY, USD/CHF, CAD/USD,GBY/JPY,EUR/USD and so many more. Right now,forex can be considered as the world largest trading market where an average of $1.9 trillion trades is done on a daily basis. The turnover rates in FOREX are nearly 30 times larger than the total volume of equity trades in United States.

Forex is relative new to the publics nonetheless. Forex trading only made available to the publics in year 1998 where big sized inter-bank units are sliced into smaller pieces and offered to individual traders like you and me. Before that time, Forex is only a game for banks, multi national cooperation, and big currency dealers.Public do not have chance to trade on that time. Only those with large business size and strong financial background were permitted to trade foreign currencies.

10:17 PM | Labels: currency, forex, learn forex, market | 0 Comments

Forex broker comparison

Here i put some comparison for the forex broker

| Broker | Min Deposit | Commission | Max Leverage | ECN? | E-Gold? | MT4? | Since |

|---|---|---|---|---|---|---|---|

| Forex Club | $10 | $4/100k | -- | Y | N | N | 2000 |

| Easy-Forex | $50 | N | ??? | N | N | N | 2001 |

| iForex.com | $100 | N | 400:1 | N | N | N | 1996 |

| Hotspot FX | $7500 | $3/100k | 50:1 | Y | N | N | 2000 |

| Forex.com | $250 | N | 200:1 | N | N | N | 1998 |

| CMC Markets | $2000 | N | 100:1 | N | N | N | 2003 |

| FXCM | $300 | N | 200:1 | NDD | N | N | 1999 |

| FX Solutions | $250 | N | 400:1 | N | N | N | 1995 |

| Realtime Forex | €2500 | N | 50:1 | N | N | N | 2001 |

| Interactive Brokers | $5000 | $2/100k | 50:1 | Y | N | N | 1998 |

| Oanda | -- | N | 50:1 | N | N | N | 2001 |

| MG Forex | $200 | N | 400:1 | N | N | N | 2000 |

| CBFX | $500 | Y | 100:1 | N | N | N | 2001 |

| GFT Forex | $250 | N | 400:1 | N | N | N | 2001 |

| EFX Group | $400 | $5/100k | 100:1 | Y | -- | N | 2000 |

| MB Trading | $400 | Y | 100:1 | Y | N | -- | 2002 |

| LiteForex | $1 | N | 500:1 | Y | Y | -- | 2004 |

| FX Cast | $1 | N | 400:1 | N | Y | Y | 2005 |

| Dukascopy | $50,000 | N | -- | Y | N | -- | 2004 |

| FX Open | $1 | N | 500:1 | N | Y | Y | -- |

| Marketiva | $1 | N | -- | N | Y | N | 2005 |

| Swissnet Broker | $200 | N | -- | Y | N | -- | 2005 |

| Ava Fx | $100 | N | 200:1 | N | Y | N | 2006 |

| Real Trade Group | $20 | N | -- | N | Y | Y | 2003 |

| Money Forex | $250 | N | ??? | N | N | N | -- |

| Forex Web Trader | $250 | N | -- | -- | -- | -- | -- |

| IFC Markets | $1 | N | -- | -- | -- | -- | -- |

| North Finance | $100 | -- | 500:1 | N | N | Y | 2003 |

| Interbank FX | $250 | -- | 200:1 | N | N | Y | 2001 |

| GFX (Forex.ch) | $2000 | -- | -- | N | N | Y | 2006 |

8:08 PM | Labels: broker, compare, forex | 0 Comments

Choosing a suitable Forex Broker

Before you decided to start to an investor,first of all, you need to find a forex broker.There are a many forex brokers you can find from the internet.Most of the forex broker will use metatrader as their platform.However,some of them will using their own platform.You need to decide which platform you can best suit.Here i list some of the forex brokerage form that mostly used worldwide.

LiteForex offers trading technology for beginner traders, and lets you start your first trading in the Forex market depositing just ONE DOLLAR! Your deposit appears in US cents on the Lite group accounts, so you feel like you are trading the same amount in US Dollars. This new technology allows Forex beginners to learn Forex in a REAL life situation with minimal investment!

LiteForex also offers competitive trading conditions for Forex professionals all around the world, and provides a dedicated Forex trading server and experienced customer support as well as analysis of Forex market and a professional affiliate program.

HY Markets is a leading online capital markets trading website. It offers both retail and institutional investors with quick and easy access to a range of financial markets including forex, oil/gas, metals, commodities, and stocks. HY Markets is a trading name of Henyep Investment (UK) Limited, authorized and regulated by the FSA of the United Kingdom and is a division of the Henyep Group, a diversified financial conglomerate with over 25 years of operational history and operations across three continents.

Dukascopy (Suisse) SA is a Swiss regulated Brokerage House. Dukascopy provides access to the first Decentralized Marketplace in the world (SWFX - Swiss FX Marketplace), combining liquidity of Centralized marketplaces and a number of banks.

Dukascopy (Suisse) SA offers direct access to the SWFX Swiss FX Marketplace, the most efficient market in the world. This exchange provides the largest pool of interbank spot forex liquidity available for banks, hedge funds, institutions and professional traders.

dbFX is an online Foreign Exchange Trading Service provided by Deutsche Bank AG. You can trade with Deutsche Bank, the pre-eminent provider of liquidity in the world's foreign exchange markets. dbFX offers online margin foreign exchange trading with real-time, streaming pricing.

A unique commision free online forex and CFDs trading system that allows you engage in trading on the world forex market.

MoneyForex Financial Ltd. is one of the world leading online currency trading broker offering low pips and commission-free online forex trading. Founded by Wall Street veterans, MoneyForex's vision is to service individual and corporate investors such as money managers, banks, and financial institutions in easing the complexity in dealing with forex trading. Our dealing software which specialized in forex dealing is rated second to none for it user friendly environment. Lightning speed and efficient execution is one of its many benefits.

GFX Group SA is unique in offering narrow spreads, 200:1 leverage, and commission-free trading in 49 currency pairs. GFX’s financial stability and substantial capitalization, combined with an outstanding level of client service, offer a secure and reliable trading environment.

The Man Group can trace its origins back to 1783 when James Man first established a sugar broking business in the City of London. Man Group PLC is now a FTSE 100 company (EMG.L) and Man Financial is the Worlds largest Independant Futures Broker.

The Company Western Capital Forex S. A. was established in Geneva (Switzerland) in February 1990 as an investment advisor and financial markets analyst. Over the years the Company gained experience in market analysis as well as in managing funds for its own account and for various international clients.

Since early 2000, the Company has been regulated by the OAR-G which is one of the self regulatory bodies in Switzerland. The Company is also member of the Swiss Group of Independent Financial Advisors (GSCGI).

A multilingual support service is operating 24 hours a day and is trained to assist the clients in every question relating to the use of the system.

FxPro offers an array of sophisticated trading tools and services including the industry's advanced trading conditions for CFDs on spot FX, Futures, stocks and spot precious metals. With in-depth brokerage, trading and banking experienced gained by company’s founders and its management, EuroOrient Securities and Financial Services Ltd through its brand name - FxPro.com, embodies its core mission: to provide clients with leading edge technology, best execution and exemplary customer service.

5:18 PM | Labels: broker, forex, money | 0 Comments

Why you should join forex?

1. TRANSPARENT, LEVEL PLAYING FIELD

All market participants can bid and offer in addition to hitting and paying the bid/offer.

Traders can save spread and commissions by entering bids and offers. Additionally, by allowing all traders to bid and offer, all traders to be market makers with an equal opportunity to

earn the bid/offer spread. This unique feature can add value to the bottom line of your

trading account.

We do not compete against customer orders,take or carry positions. This avoids a conflict of interest inherent in FX trading. All trades are executed following interbank protocol.

Profe

ssional, experienced, FX experts manage our sales/trading customer service desk. Stop

ssional, experienced, FX experts manage our sales/trading customer service desk. Stoploss and take profit orders are watched and executed with great care. Because we do not

trade against customer orders, our execution desk is 100% focused on facilitating

customer orders.

Most of the forex broker spreads on forex in the major currency pairs are consistently 1 to 3 points wide, with most pairs quoted in 10 million units.

All prices on are live or realtime. When a trader clicks on a price there is no need to wait for confirmation that the price is still 'good'. The price you see is the price you deal on.

Fast isn't the right word for the platform. Sub-second execution is.

Traders' identities, trading activities and positions are fully anonymous.

Trading platform provides valuable market data: Prices and sizes for all bids/offers, the number of participants on each bid/offer are seen by all clients. Real-time, web-based reports are available 24 hours a day.

10. EARN INTEREST ON TRADING POSITIONS/ACCOUNT BALANCES

Client positions long a higher interest bearing currency/short a lower interest bearing currency earn interest. Also, accounts with balances exceeding $20,000 earn competitive interest rates

12:57 AM | Labels: forex, money, tips | 0 Comments

How To Control Risk??

Trading forex comes down to risk management. If a forex trader takes a position in a currency, and sits on it for 3 months, while he may profit, he is exposed to the same kind of risk as if he were not trading. In other words, during that 3 month period, many things can happen to make that position open to risk. Utilizing stop losses, and actively trading, is in itself a risk management policy, rather than a strategy of knowing where the market will go. For a forex trader, the risk management side is inherently more important than guessing which direction the market will go.

It is those funds and forex traders, who are maxed to the hilt with high margins, with no stop losses, that expose their clients to the huge risks in the forex markets. Consider purchasing 100k EUR/USD at 1.2020 expecting a rise to 1.2100 (with a stop at 1.2000). If you are trading 100,000, you have taken a 100% cash position. If the EUR/USD goes as expected, you would make a profit of $800, or .8%. If it goes against you, you would lose $200, or .2%. So you are risking .2% to gain .8%. What many traders might do is take a 1,000k (1 million) position, which is 10:1 margin. This increases your P/L by 10 x - so that .2% loss is 2%, and the .8% gain is 8%. This is where risk comes into the forex market. So, it is not the forex market itself, or forex trading itself, that is risky, but rather, the risk management policy of forex dealers. Good dealers will first have a solid risk management policy, and second, develop a trading strategy.

Finally, during volatile times, or if a trader just wants to have a go at making 100 points, it is possible to take a less than 100% cash position, totally limiting the risk of loss. Using the example above, where you have 100,000 in your account, it is possible to trade 10k lots instead of 100k lots, putting you in a position of only 10% cash, or negative margin. This means the above trade loss goes from .2% to .02% - as well, your gains are also limited to .08% instead of .8%. However during certain volatile times trying to make a small profit may be better than exposing funds to potential losses.

Forex trading allows for a great degree of risk management not available in other capital markets. Margin, being able to buy or sell without limit, high liquidity (2.3 trillion traded daily), and a 24/6 market, give only the forex market to be so flexible regarding risk. In other words it is not possible to have such a sophisticated risk management policy in other markets.

- Buy OR sell (compared to stocks where you can not always go short)

- Always find a buyer or seller (the forex market is the only real liquid market in the world. It is impossible you want to trade and cannot find a buyer or seller)

- Use high margin, or trade conservatively

- Take opposite positions at the same time

- Take multiple positions (instead of selling EUR/USD, take multiple EUR positions against the crosses such as EUR/GBP, EUR/CHF, as a hedge against your first EUR/USD position)

The above factors are the real opportunities in the forex market, not the potential to make 100% that exist in other markets such as the stock market.

12:12 AM | Labels: control risk, forex, money | 0 Comments

What Is Forex Trading??

The Forex market is a non-stop cash market where currencies of nations are traded, typically via brokers. Foreign currencies are constantly and simultaneously bought and sold across local and global markets and traders' investments increase or decrease in value based upon currency movements. Foreign exchange market conditions can change at any time in response to real-time events.

The main enticements of currency dealing to private investors and attractions for short-term Forex trading are:

- 24-hour trading, 5 days a week with non-stop access to global Forex dealers.

- An enormous liquid market making it easy to trade most currencies.

- Volatile markets offering profit opportunities.

- Standard instruments for controlling risk exposure.

- The ability to profit in rising or falling markets.

- Leveraged trading with low margin requirements.

- Many options for zero commission trading.

12:01 AM | Labels: forex | 0 Comments