Not Found?? Search Here...

Be A Success Trader

To be successful in the trading game, there are some rules you need to follow. By violating the rules, you will definitely on the losing side of the game. Regardless of all the trading books and newsletters that have cropped up, all of the market gurus are sharing and following the same trading rules. You can’t live without them if you want to succeed in your trading.So,please put in mind all these rules,and make it as your routine rules when to start trading. Here are the rules to successful trading, in random order, and they apply in all trading situations:

To be successful in the trading game, there are some rules you need to follow. By violating the rules, you will definitely on the losing side of the game. Regardless of all the trading books and newsletters that have cropped up, all of the market gurus are sharing and following the same trading rules. You can’t live without them if you want to succeed in your trading.So,please put in mind all these rules,and make it as your routine rules when to start trading. Here are the rules to successful trading, in random order, and they apply in all trading situations:

Good luck in your trading...Happy trading! :-)

- Plan Your Trade And Trade Your Plan

- The Trend Is Your Friend

- Focus On Capital Preservation

- Know When To Cut Loss

- Take Profit When The Trade Is Good

- Be Emotionless

- Do Not Trade Based On A Tip From A Friend Or Broker

- When In Doubt, Stay Out

- Do Not Overtraded

9:58 PM | Labels: forex, forex tips, forex trading, learn forex, successful trader | 0 Comments

Risk only small percentage of total account

When playing a forex,a money management is very important.Money management is a way traders control their money flow: in or out of pockets... Yes, it's simply the knowledge and skills on managing a personal Forex account.There are several rules of good money management,one of that is by putting a small risk percentage of your total account.

Why is it so important?

The main idea of the whole trading process is to survive!

Survival first, and only then making money on top.

One should clearly understand, that Big traders first of all are skillful survivors. In addition, they usually have deep pockets,which means that under unfavorable conditions they are financially able to sustain big losses and continue trading.For the ordinary traders, the majority of us, the skills of surviving become a vital "must know" platform to keep trading accounts alive and, of course, to make good stable profits.

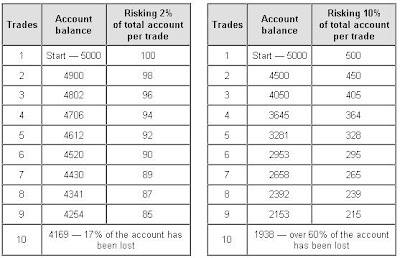

Let's take a look at the example that shows a difference between risking a small percentage of capital and risking a bigger one.In the worst case scenario of ten losing trades in a row the balance of trader's account will suffer this much. Below are the table of your money management as your guide.

source:freeforextips

11:11 PM | Labels: forex, forex money management, forex tips, fundamental analysis, learn forex, money management | 0 Comments

Another tips for beginners...

Not trading or standing aside is a position.

Not trading or standing aside is a position.

When in doubt , stay out. If you are not clear or cannot predict correctly where the market will move,don't trade. Saving present capital is and absolutely better choice than risking and losing money.

Learn to use protective stops. Respect them and don't move.

Hoping that market will turn in your direction is a very delusive hope. By moving a stop loss further a trader increases his chances to end up with much bigger loss.

"Keep it simple, stupid" — applies to indicators, signals and trading strategies.

If you get too much information,it will create a controversial picture of where to trade and when not to. To avoid lots of confusion create a simple but working method of trading forex.

Think about risk/reward before entering each trade.

How much money can you lose in this trade? How much can you gain? Now, make a decision if the trade is worth entering.

Never add positions to a losing trade. Do add positions when the trade has proven to be profitable.

Don't allow a couple of losing trades in a row become a snowball of losing trades. When it is obviously not a good day, turn the monitor off.Trying to get revenge can often make things worse.

Let your profits run.

Let your position be open for as long as the market wishes to reward you. Of course, for this traders need a good exit strategy, otherwise they risk to give all profits back.

Cut your losses short.

It's better to finish unprofitable trade quickly than wait for the situation to get worse. Don't put a stop loss too far, it's your money you risk.

Trade currency pairs in respect to their active market hours.

Learn about overlapping market hours: when two markets are open and highest volume of trades is conducted. For example, Australian and Japanese trading sessions are overlapped from 8pm to 1 am EST. At that time trader can successfully trade AUD/JPY currency pair.

That's all..and good luck!!

2:40 AM | Labels: forex, forex tips, learn forex | 0 Comments

How does a faulty Forex broker cheat your money?

Forex market is a non-centralized market.Its mean that,in the forex market there is no common market place for traders and there is no ‘standard’ in the currency exchange price. Different Forex brokers will offer very different deals to their customers.

As an individual forex trader, you will totally depends on the broker to make a transaction in your trades, thus picking up the right broker is the most important part in forex trading.

You may wonder how does a faulty broker can cheat on your money as all investment call have to go thru your decisions.

here is some example:

Often a bad broker is not totally scams.

They are smart persons that trick money from traders that are not well-aware. These brokers, often known as retail market makers, will often encourage their clients to trade on margin and set stop loss orders, which allow the market makers to close out trades almost at will during busy markets at prices they have set. If the market maker does not offset the trader's position, the loss generated when a stop loss is triggered becomes the market maker's gain.

Trade prices are easily skewed one way or the other depending on the retail trader's position, which is known by the market maker.

Traders can be encouraged to take risky positions just before major economic announcements. If all else fails, the market maker can quote extreme prices (known as spiking) to trigger stop loss orders while the client is at work or asleep.

The vast majority of retail FX traders are not profitable. For those losing retail speculators, much of the funds they had on deposit will be, in some form or another, transferred to the market maker.

6:37 AM | Labels: faulty forex broker, forex broker, forex tips, learn forex | 0 Comments

How does margin trading in the forex market work?

When an traders uses a margin account in trading a forex,they actually borrowing to increase the possible return on investment. Usually, many traders will use margin accounts when they want to invest in equities by using the leverage of borrowed money to control a larger position than the amount they'd otherwise by able to control with their own invested capital.

When an traders uses a margin account in trading a forex,they actually borrowing to increase the possible return on investment. Usually, many traders will use margin accounts when they want to invest in equities by using the leverage of borrowed money to control a larger position than the amount they'd otherwise by able to control with their own invested capital.

Traders interested in trading in the forex markets must first sign up with either a regular broker . Once an investor finds a proper broker, a margin account must be set up. A forex margin account is very similar to an equities margin account, the investor is taking a short-term loan from the broker. The loan is equal to the amount of leverage the investor is taking on.

Before the traders start to trade, they must pay a sum of deposit into their margin account. The amount that needs to be deposited depends on the margin percentage that is agreed between the traders and the broker upon registration or opening the account. For accounts that will be trading in 100,000 currency units or more, the margin percentage is usually either 1% or 2%. So, for an traders who wants to trade $100,000, a 1% margin would mean that $1,000 needs to be deposited into the account. The remaining 99% is provided by the broker. No interest is paid directly on this borrowed amount.However,if the traders does not close their position on the following day or before the delivery date, it will have to be rolled over.Forex brokey may charge the interest depending on the investor's position (long or short) and the short-term interest rates of the underlying currencies.

In a margin account, the broker uses the $1,000 as security. If the trader's position get worse and they losses approach $1,000, the broker may initiate a margin call. When this occurs, the broker will usually instruct the traders to either deposit more money into the account or to close out the position to limit the risk to both parties.

4:23 AM | Labels: forex, forex margin, learn forex, margin trading | 0 Comments

Use Stop Loss Effectively

In Forex trading,stop loss is not a great tool or technique for many traders as it requires taking necessary losses, calculate risks and foresee price turns. However, such money management tool in hands of a knowledgeable trader becomes rather a powerful trading weapon than a tool of disappointment and painful losses. There are several method we can apply stop-loss when start trading

In Forex trading,stop loss is not a great tool or technique for many traders as it requires taking necessary losses, calculate risks and foresee price turns. However, such money management tool in hands of a knowledgeable trader becomes rather a powerful trading weapon than a tool of disappointment and painful losses. There are several method we can apply stop-loss when start trading

Simple equity Stop

According to this rule, a trader would place an order and based on a lot size would calculate amount of pips required to reach the limit of 2-3% of the total account balance (and a stop loss will be placed at that point).

Chart based Stop

There are many approaches to placing protective stops using a chart based stops: stops based on swings high / low, stops using trend lines, fibonacci related stops and so on.

Margin Stop

first, the trader should divide his account into several equal pieces to ensure that the whole capital will not be blown off in one shot.Supposing that a trader plans to spend 15 000 USD, it is suggested that the account opened with a broker "weights" between 1000 to 2000 USD.

6:18 AM | Labels: forex, learn forex, stop loss | 0 Comments

How currency exchange market works

Forex market exists where one currency is traded for another currency. Foreign Exchange Market or formally known as FOREX, is generally works as an international currency exchange market. Investors and speculators now allowed to trade any currencies from all around the world thru the Forex market.

Forex market exists where one currency is traded for another currency. Foreign Exchange Market or formally known as FOREX, is generally works as an international currency exchange market. Investors and speculators now allowed to trade any currencies from all around the world thru the Forex market.

Forex is a very unique type of trading where traders are buying and selling 'money' in the same time. All the trading in forex market are done in pairs, such as Euro/JPY, USD/CHF, CAD/USD,GBY/JPY,EUR/USD and so many more. Right now,forex can be considered as the world largest trading market where an average of $1.9 trillion trades is done on a daily basis. The turnover rates in FOREX are nearly 30 times larger than the total volume of equity trades in United States.

Forex is relative new to the publics nonetheless. Forex trading only made available to the publics in year 1998 where big sized inter-bank units are sliced into smaller pieces and offered to individual traders like you and me. Before that time, Forex is only a game for banks, multi national cooperation, and big currency dealers.Public do not have chance to trade on that time. Only those with large business size and strong financial background were permitted to trade foreign currencies.

10:17 PM | Labels: currency, forex, learn forex, market | 0 Comments